|

Tinyman Explained

Last Reviewed: January 2023

In this AlgoDaddy article we're talking about Tinyman - Algorands first DEX and token swap. I know a lot of you have requested this, so it was time to get down and dirty, and finally introduce you to the magical crypto world of token/ASA swapping. With Algorand it's much easier and less scary than you'd think!

The Article Consist of 3 Major Parts:

1. What is Tinyman

2. Liquidity Pools on Tinyman Explained

3. Step-By-Step Guide on How to Swap using Tinyman

3. Step-By-Step Guide on How to Swap using Tinyman

But before we begin I'll quickly explain the concept of ASA for those unaware.

What is an ASA?

ASA stands for Algorand Standard Asset. In simple terms ASA is just Algorands fancy naming of the crypto tokens available on its protocol. However, in reality it's a bit more complex than that, ASAs offer plenty of utility and different use cases and doesn't simply act as a cryptocurrency. If you're interested to read more, then I have explained ASAs previously.

Want to know how Algorand works in greater detail?

What is Tinyman?

Tinyman is a decentralized exchange (DEX) and marketplace for all tokens on the Algorand blockchain. It was launched on 7th of October 2021 and raised a total of $2.5 million from different investors prior to launch.

The Tinyman platform is revolutionary to Algorands ecosystem. It allows liquidity pools to be formed between Algorand and different ASAs, or even between the ASAs themselves. In other words, you don't need a token to be listed on an exchange to trade it. In addition, users and developers can set up their own liquidity pools for token pairs previously not existing. Not only that, but all of this is provided by a secure, cheap and fast protocol - much thanks to Algorands underlying technology.

The version 2.0 of Tinyman was launched in January 2023. The new version of Tinyman includes improvements of the user experience as well as new features, such as Flash Loans, Flash Swaps, Dynamic Fees, Metapools, Flexible Liquidity Management and Composable Calls.

|

| Tinyman Roadmap for 2022 |

The Tinyman Effect

The Tinyman launch resulted in a much more accessible ecosystem and a more engaged Algorand community. Users we're now able to freely trade the popular Algorand tokens (Yieldly, Opulous, Headline, among others). Additionally, several new community tokens were created and they quickly rose in popularity, with the most well-known being Akita Inu Token.

Nonetheless, you probably know that many scam coins were created after Tinymans launch as well. Although avoiding these have become easier with time, much thanks to implementations from the Tinyman developers and due to the general community awareness increasing.

Swap Inside Pera Algo Wallet

The Pera Algo Wallet has partnered up with Tinyman in order to allow real-time swapping inside the wallet dApp. This allows for a seamless and smooth experience, where the users can quickly access and engage in the Algorand DeFi system through their phones app.

Pera charges an industry standard fee of 0.8% for any swap, but if you hold any Pera Algorand Governance NFT you will receive a discount of 50% on that service fee, resulting in a 0.4% fee.

AlgoSwap

The Algorand-based company HEADLINE launched AlgoSwap - the worlds first embeddable decentralized exchange. With just 7 lines of code users can now host an embedded DEX right on their websites (Wordpress blogs, company homepages, etc). AlgoSwap is powered through Tinymans liquidity pools.

|

Tinyman Liquidity Pools

It's fundamental to understand the concept of Liquidity Pools if you're in any way engaging in a DEX or Swap platform. Liquidity pools are what makes swapping crypto or tokens on Tinyman possible. Anyone can contribute to a Tinyman liquidity pools, however you need to provide equal worth of both tokens (in USD). Liquidity providers collectively earn 0.25% on each swap made through a pool. This means your reward will depend on how large % of the pool amount you're providing to the pool in total (0-100%).

For example, if you provide 10% of a pools liquidity, and said pool earned $100 during a day through transaction fees, then you'd get 10% out of the $100, i.e. $10.

Having participants provide liquidity to the token pools is essential for the health of a token or project. However it should primarily be the responsibility of the project developers to do this at the inception of the project, as it can be very risky for the community to shoulder this investment initially.

Risks with providing liquidity on Tinyman

With that being said providing liquidity is not without risk. You're essentially invested in two different tokens at the same time, and the pool constantly rebalances your two tokens between each other. Meaning you might put in 100 ALGO and 7000 Yieldly into the ALGO-YLDY pool, only to find out that you get 50 ALGO and 14000 YLDY back. This mainly depends on how the price for the two different tokens change in relationship to each other.

Impermanent Loss!

Additionally it's not obvious that you'd make bank from only one of the tokens increasing greatly in price. In fact, it's more likely the opposite, you lose out on most of the massive gains. This is something known as impermanent loss. Don't let the name fool you, that loss can be very permanent. Even worse if both tokens go down in value at the same time. Read more about impermanent loss. The article we've linked is written for providing liquidity on Ethereum DEXs, though the concept applies for swaps on the Algorand blockchain through Tinyman.

Rug-pulls!

With the inception of Tinyman there have been plenty of microtokens and "projects" that are basically scams. The term rug-pull means a creator of a certain token pull out all the ALGO from an LP when enough users have provided ALGO to the pool in hopes of "helping" the project. They do this through false marketing, and falsely inflating the price of the token by manipulating the Tinyman system. I won't go into details of how it works, but essentially they have the power to sell off their share of the created tokens, completely draining the pool of ALGOs. This leaves LP holders with their % of the liquidity pool being worth only 0.1 ALGO and 100000 $ScamTokens (while the user might have initially put in 100 ALGO and 1000 $ScamTokens).

Here's my 3 rules for first time liquidity providers:

- When starting out and learning how providing liquidity on Tinyman works you should provide only to pools where one token is a stable coin (USDC, USDT). This mitigates the risk for loss, as both coins can't lose value at the same time.

- Provide liquidity if you believe in a token and want to help it grow. Make sure it's verified and has a legit project plan. Even better if the identities of the developers are known to the public.

- Don't provide LP to unverified tokens. At least the risk of getting rug-pulled will be smaller.

Finally, don't invest what you can't afford to lose. I didn't put this in the 3 rules above, because this should be common sense and advice not limited to Tinyman.

How to Swap on Tinyman

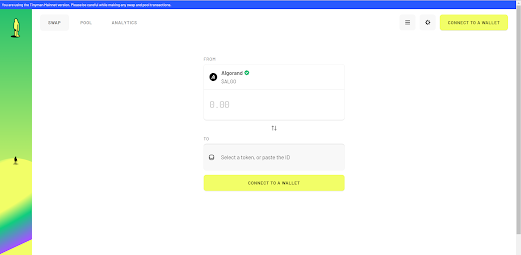

Using Tinyman for Swapping tokens is easy. Here are the 5 quick steps to complete your first swap.

- Open the Tinyman Application in Your Browser

- Connect Your Algorand Wallet to Tinyman

Scan the QR code through the wallet application. Confirm and opt-in.

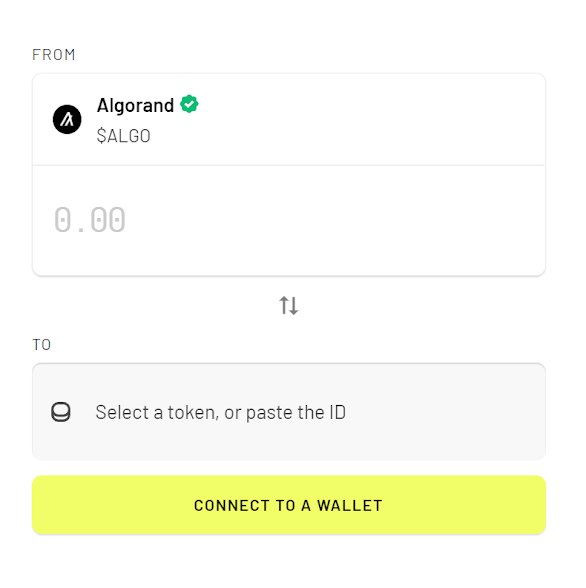

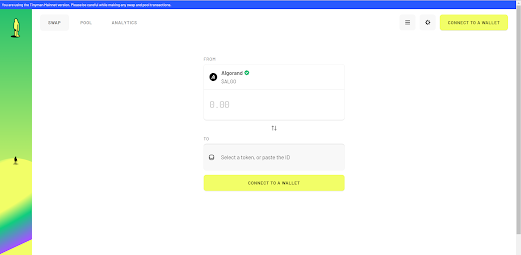

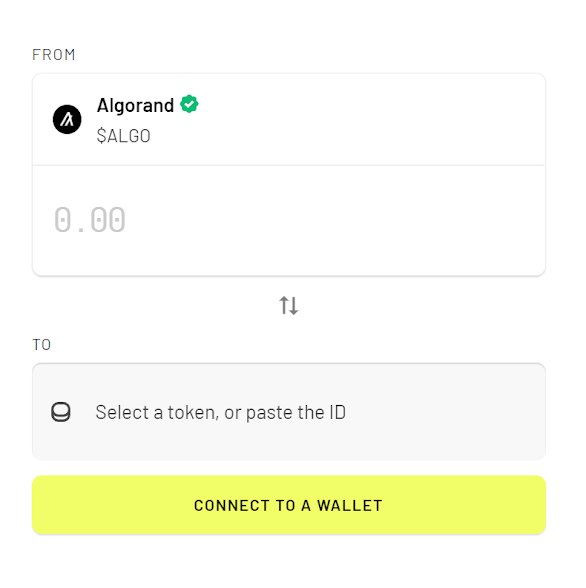

- Select the 2 Tokens You Want To Swap

For this guide I'm using ALGO and Yieldly. Chose the amount you want to swap. Press OPT IN if you don't have the token in your wallet already.

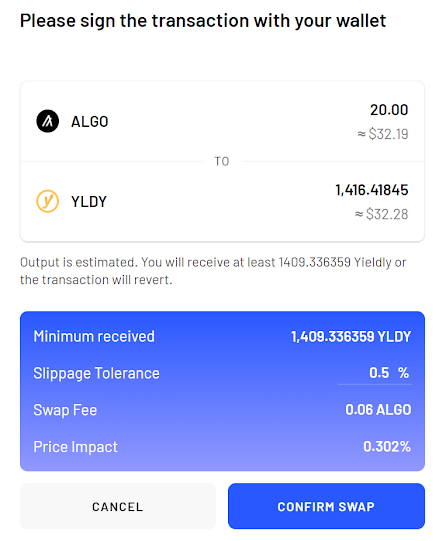

I also recommend keeping slippage at 0.5%. - Press SWAP then CONFIRM SWAP.

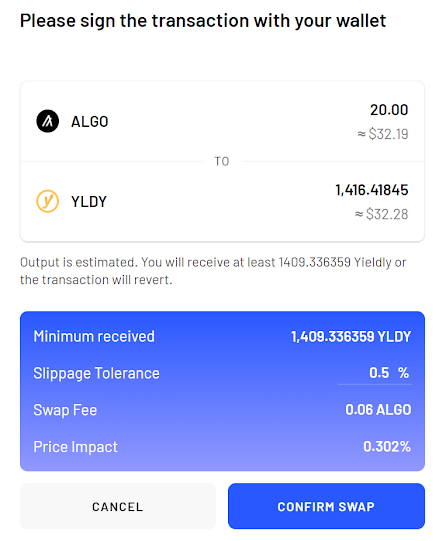

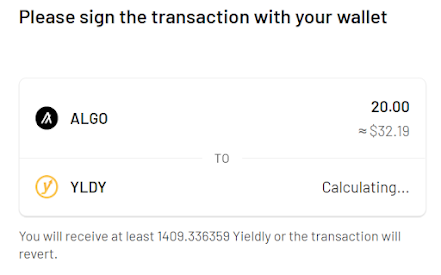

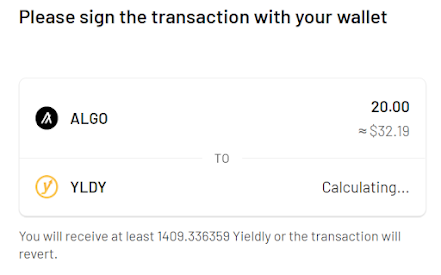

- Sign the Tinyman Swap on Your Algorand Wallet Application

I can't showcase this step as the app doesn't allow for screenshots, but there will be a pop-up in your Algorand Wallet asking you to confirm the transaction.

|

Scan the QR code through the wallet application. Confirm and opt-in.

|

For this guide I'm using ALGO and Yieldly. Chose the amount you want to swap. Press OPT IN if you don't have the token in your wallet already.

I also recommend keeping slippage at 0.5%.

|

I can't showcase this step as the app doesn't allow for screenshots, but there will be a pop-up in your Algorand Wallet asking you to confirm the transaction.

|

Congratulations, You've Made Your First Swap!

Tinyman - Final Words

The Tinyman DEX have truly been disruptive to the Algorand ecosystem - and I mean that in the best possible way. The Algorand blockchain allows for new tokens to be easily minted using it's secure, scalable and fast technology. Being able to swap tokens between each other or Algorand is not only an important step for decentralization, but also for ecosystem engagement and expansion.

"There are profits to be made and risks to be taken."

Understanding how liquidity pools works is fundamental for those engaging in DEX or Swap platforms, such as Tinyman. You can make a good profit, but diving into the depth of decentralized finance can hurt you if you don't know what you're doing. Educate yourself before swapping or providing liquidity. By reading this article you've already taken a step in the right direction, so good job on that!

Recommended Read:

0 Comments