|

Algofi: Algorand Lending & Stablecoin

❗ UPDATE ❗

This article will cover the recently launched Algorand platform Algofi. For those who you who are uninitiated - Algofi was one of the most anticipated additions to the Algorand ecosystem of 2021. Almost as impactful as Tinyman, but of course in its own unique way. You probably already know that the new generation of DeFi cryptocurrency demands that blockchains offer a wide variety of use cases, however there are certain critical functions an ecosystem requires to pull capital and spur rapid growth. Lending being one of them.

Algofi is one of the three DeFi "pillars" defined by the Algorand Foundations Aeneas Program, which goal is to bootstrap Algorand DeFi:

- Robust Bridges for Newcomers - AlgoMint

- Automated Market Maker DEXs for Traders & Merchants - Tinyman

- Borrowing & Lending Platform for Capital & Commerce - Algofi

- What is Algofi?

- What does Algofi offer?

- Why use Algofi?

- How to use Algofi

What is Algofi?

Algofi is the first lending platform on Algorand. In addition to facilitating borrowing and lending, it also provides an Algorand-native stable coin, known as STBL.

Algofi went live on the Algorand mainnet December 17th 2021 after several months on the test-net. It was audited by Runtime Verification for security purposes. Tinyman raised over $2.8 million USD before launch, having financial backing from Arrington XRP Capital, Union Square Ventures, and others. It was founded by Owen Colegrove & John Clarke.

Most recently Algofi announced a rewards program the size of 2 Million ALGO, which will further incentivize lenders for the first quarter of 2022 (in addition to any interest from lending).

In the future Algofi is planning to offer more classical banking services, such as credit cards and savings accounts, which would be powered through Algorands rapidly growing ecosystem.

|

What does Algofi offer?

Lending & Borrowing

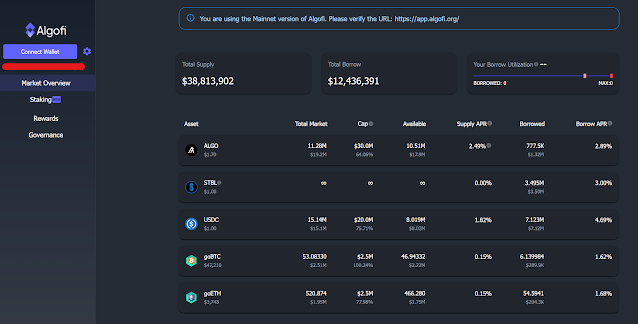

Algofi primarily offers users to lend or borrow on the platform. At the moment, as you can see from the picture above, Algofi offers lending for 5 different tokens on the Algorand blockchain: ALGO, STBL, USDC, goBTC and goETH.

STBL is the native stable coin provided by Algofi. A stable coin means its price is not meant to fluctuate much, if at all. This means 1 STBL ≈ $1.00 at any given time.

USDC is a stable coin available on many different blockchains (Ethereum, Solana, Algorand, and others).

goBTC and goETH are simply BTC and ETH respectively converted to the Algorand protocol using AlgoMint.

Note: You should know that the amount you can borrow is limited by the amount you supply back to Algofi (i.e. supply). This means you must first lend Algofi before you can borrow. The borrow rate is approximately 80% of your total lent value. As such, your supply is used as collateral to keep the platform secured and provided with liquidity at all times.

Staking for STBL

Why Use Algofi - Algorand Lending

The most common questions I've seen concerning lending and borrowing on Algorand is "Why Borrow on Algofi I anyways can only borrow 80% of my collateral?".

Below I present a few reasons why (not a exhaustive list by any means).

Leverage

There might be several reasons, but the most important one is to get leverage. You still own the Algorand you provide to Algofi, and it can be withdrawn at any moment as long as you have paid back your existing loans. This should be pretty tempting for anyone not participating in Algorands Governance Program.

For example, you could provide 1000 ALGO to Algofi, earn APR on that amount, then borrow STBL and convert it into additional ALGO (using Tinyman), which you can invest in other parts of the ecosystem.

|

| Current est. APY of some Yieldly Staking Pools as of writing this article. |

Higher Return Complex Staking

Another way is lending your ALGO to Algofi, then borrow 80% of that value in USDC. Convert the USDC to Yieldly, which you use to stake in high-yield staking pools on their platform (some pools offer 30-100% APY). As soon as the pool is finished you can swap the staking reward to ALGO or Yieldly, and use it to repay the loan on Algofi. This can amount to a higher APY then just letting your ALGOs sit in Governance, although it must be noted that this can be a risky alternative as very many factors effect the potential return (fluctuating prices of Yieldly or the value of the token earned from staking, tax implications, fluctuating staking pool APY, etcetera).

WARNING - Risk of Liquidation

Users who fail to maintain their collateral are liquidated, these processes must run smoothly for the protocol to remain solvent. This means that if you're loaned amount starts to approach 100% of your collateral instead of 80%, then you are at risk of liquidation. Consequently Algofi seizes a part of the collateral. This can happen if ALGO drops in price versus USD, and your collateral is no longer worth as much as it was previously (in terms of USD). It's crucial that you understand this concept before borrowing anything using the platform. Algofi explains this in more detail and provides examples in their FAQ.

Disclaimer: This is not financial advice. Borrowing and lending carries inherent risks to it. Carefully do your research before engaging with any platforms presented on AlgoDaddy. Your capital is at risk.

How to Use Algofi?

Here is a step-by-step guide on how to borrow using Algofi. I found it to be a very smooth process myself. You need to have an Algorand Wallet installed for it to work.

I recommend getting the official Algorand Wallet if you haven't already. I have written an Algorand Wallet Guide on how to set it up.

1. Go to https://app.Algofi.org/ and press "Connect Wallet"

|

2. Scan the QR-code and "OPT IN".

Approve the Transactions on your Algorand Wallet.

|

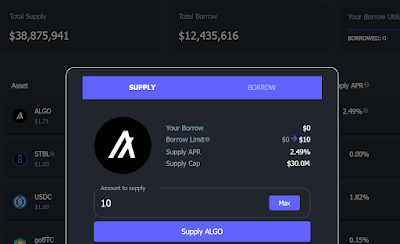

3. Now - First We Have to Supply To Algofi

Press the Token You Wish To Supply. In this guide I'm lending Algorand, and borrowing STBL. Chose the amount and press "Supply ALGO". Accept the transaction in your mobile wallet.

|

4. Success! Now We Can Borrow.

We can borrow STBL at approx. 80% of the value we supply Algo.

|

5. Again, Sucess! Use Your STBL as You Wish.

We have now lent and borrowed through Algofi. That's bonkers.. or should I say bankers. But remember that it's a LOAN and you're paying interest!

Disclaimer: This is not financial advice. Borrowing and lending carries inherent risks to it. Carefully do your research before engaging with any platforms presented on AlgoDaddy. Your capital is at risk.

Final Words

Algofi is both an anticipated and necessary addition to Algorand that will allow for further expansion of the ecosystem. Lending and borrowing in particular enables flow of capital and can attract more serious investors to the blockchain. Algofi can be used by smaller investors as well, though as with any lending there are inherent risks associated with it that needs to be taken into consideration.

If you enjoyed this article, consider donating. It helps me produce even better Algorand guides and articles. I write these posts outside of my already busy personal life, and any support is highly appreciated.

Follow me on Twitter or subscribe to my newsletter (below this article) to stay updated for when I post my latest articles.

0 Comments